Income Tax

Income Tax

Income Tax Insurance

There isn't much room for error when preparing a client's taxes. But no matter how careful you are and how many systems of oversight you’ve developed, mistakes and misunderstandings can occur. When preparing taxes for clients, your mistakes might not just inconvenience your customer but could also make them lose money and result in IRS penalties or audits. When this happens, you could quite easily face a lawsuit. Professional liability insurance (E&O) covers this specific threat to your livelihood. Not only does E&O cover the cost of defending yourself against a lawsuit but it can also cover claims awarded to your clients (including for IRS penalties and interest) within limits.

Commercial Property

In addition to professional liability insurance, tax preparers should protect their business property through a commercial property insurance policy. This will provide some general liability coverage in the event that an individual is injured or their property is damaged on your premises. The policy will also provide some compensation when your building or contents are damaged in a covered incident.

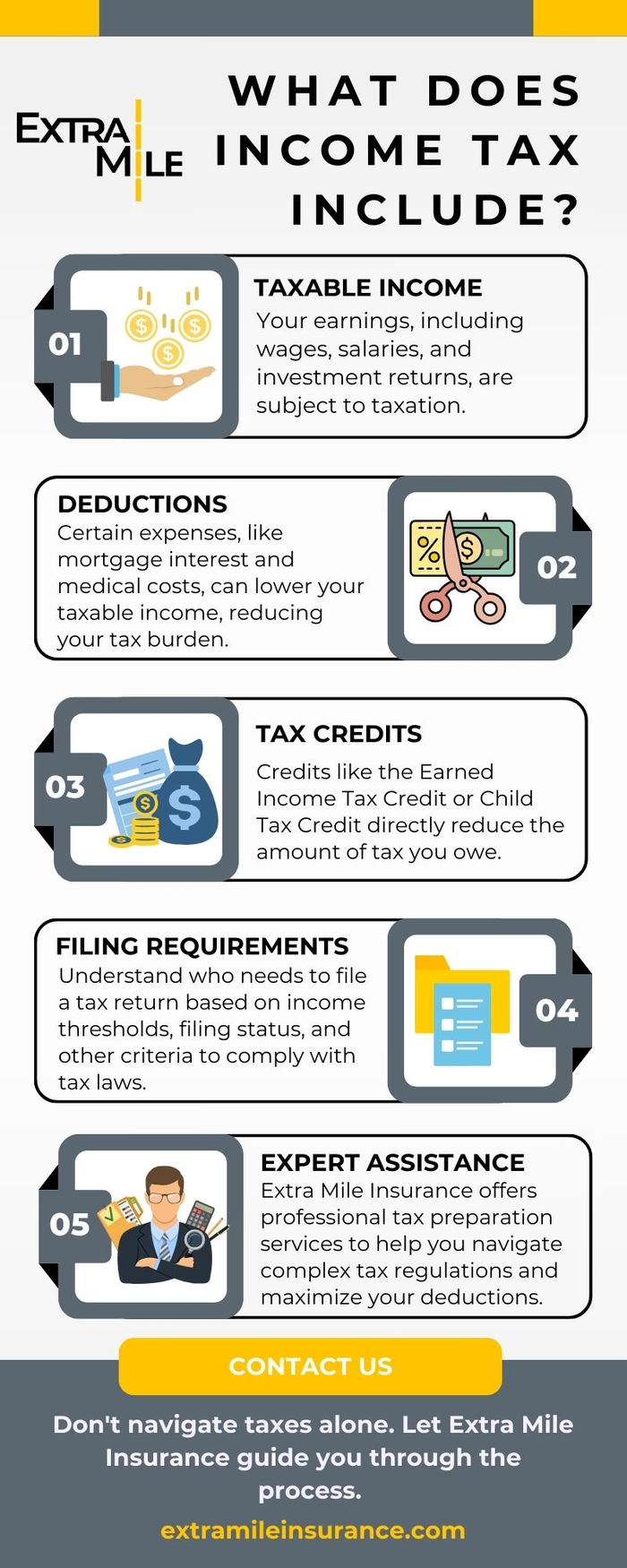

What Does Income Tax Include?

Maximize Your Tax Savings with Extra Mile Insurance's Income Tax Services! Discover essential tips and expert insights to help you navigate the complex world of income tax. From deductible expenses to tax credits, our infographic breaks down everything you need to know in a visually engaging format. Don't miss out on potential savings - let Extra Mile Insurance guide you towards optimal tax planning and ensure you're making the most of your hard-earned money. Check out our Income Tax services today!